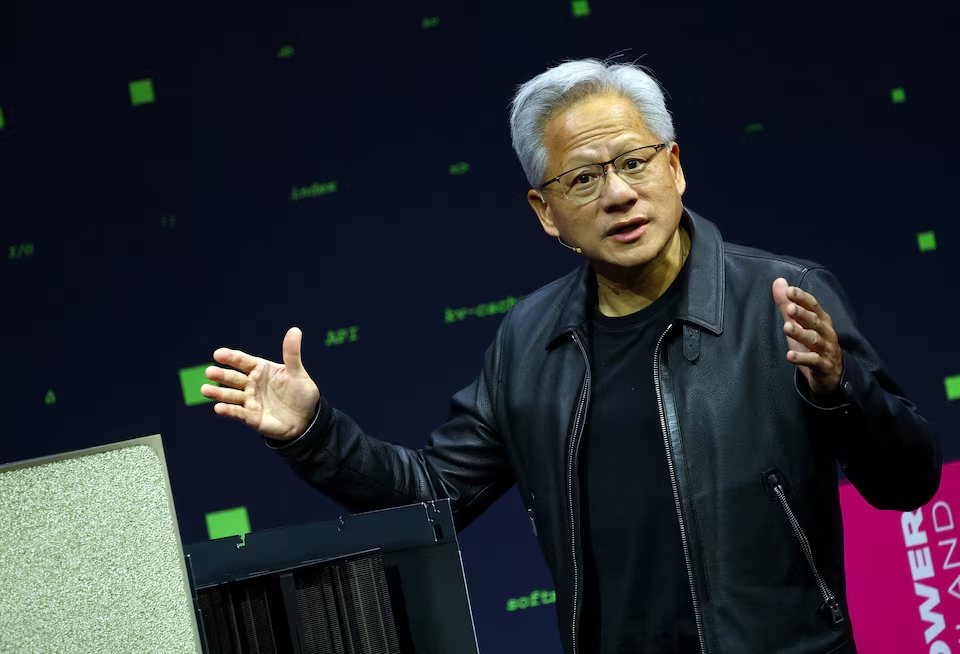

Nvidia CEO Says No ‘Active Discussions’ on Selling Blackwell Chip to China 2025 :- For years, the semiconductor industry has stood at the crossroads of technology and geopolitics. At the heart of that intersection today is the saga of Nvidia’s cutting-edge AI chip, Blackwell, and the company’s position regarding taking it into the world’s largest chip market: China. On November 7, 2025, Nvidia Chief Executive Jensen Huang made it clear: the company is not in active discussions to sell Blackwell chips in China, and no shipments are currently planned.

Setting the Scene

Blackwell is the successor to Nvidia’s previous flagship AI architectures, designed to power massive data-centres, generative-AI workloads, and high-performance inferencing tasks. But despite its technical prowess, Blackwell has become something more than just a chip—it has become a symbol in the US-China technological rivalry and export-control battles.

The United States has already banned (or severely restricted) the sale of Blackwell to China, citing national-security concerns and the risk of enabling military or dual-use AI applications in China. Meanwhile, speculation had swirled that the recently renewed talks between US President Donald Trump and Chinese President Xi Jinping might pave the way for a “scaled-down” version of Blackwell being permitted for China. Those hopes have been dashed, at least for no. Nvidia CEO Says No ‘Active Discussions’ on Selling Blackwell Chip to China 2025

What Huang Said

During a visit to Taiwan, at a sports-day event held by longtime manufacturing partner TSMC, Huang remarked publicly: “We currently are not planning to ship anything to China.” He added that while Nvidia would welcome China’s market when policy allows, the ball was in China’s court: “It’s up to China when they would like Nvidia products to go back to serve the Chinese market. I look forward to them changing their policy.”

In short: no active talks, no agreements, and no planned shipments of Blackwell to China.

for more information check this

Why This Matters

Tech-Race and National Security

Blackwell’s processing power and inference capacity make it a valuable asset in AI research, high-end super-computing, and potentially in defence-related systems. For the U.S., allowing such a chip to reach China risks eroding its technological lead and could inadvertently support Chinese military AI development. Hence the strict export-control regime.China’s Importance—and Absence—For Nvidia

China has long been the world’s largest (or one of the largest) markets for semiconductors. Yet for Blackwell, Nvidia’s presence is effectively zero in China. According to Huang, China does not currently want Nvidia’s advanced AI chips in its market. Losing access to China is therefore not just about restrictions—it is also about demand, local policy, and the diffusion of domestic Chinese alternatives.Supply-Chain and Manufacturing Implications

Nvidia relies heavily on TSMC and other foundries for advanced chip manufacturing. A stall in access to China does not just impact direct sales—it also influences strategic decisions about manufacturing scale, capacity allocation, regional risks, and future R&D focus.Global Trade & Export Controls

The US export-control framework continues to tighten. Recently, the US declared publicly that it will not permit Nvidia to sell its “most advanced” chips (i.e., Blackwell) to China at this time. Nvidia’s statement aligns with this policy.

The Chinese Market: Potential and Challenges

China’s AI ambitions are well-documented: vast amounts of data, large numbers of researchers, and strong government backing. In May 2025, Huang himself declared U.S. export rules to China were “a failure,” arguing they had only accelerated China’s AI ambitions. However, the regulatory, policy and business-environment barriers in China are also substantial. For Nvidia:

The advanced chips targeted for data-centre and research use are barred from China.

Domestic Chinese players are growing stronger, reducing Nvidia’s historical market share.

Local policy sometimes requires replacement, localisation, or risk of being cut out entirely.

Huang said: “China is where 50% of the world’s AI researchers are… We want AI researchers to build on Nvidia. … The export control gave them the spirit, the energy, and the government support to accelerate their development.” So while China is a large opportunity, it is also a complex theatre where local and global forces converge.

Export Controls & Blackwell: The Regulation Angle

The US government’s decision to restrict Blackwell sales is rooted in the Export Control Reform Act and subsequent regulations aimed at preserving strategic advantage.

In early November 2025, the White House confirmed: “As for the most advanced chips, the Blackwell chip, that’s not something we’re interested in selling to China at this time.”

Nvidia’s statement lines up: no active negotiations, no planned shipments, and waiting for policy change.

That policy environment sets the boundaries for what Nvidia can do—and what China can obtain.

Implications for Nvidia

Revenue Opportunity Foregone: Access to China has been historically important for Nvidia’s growth. The inability to sell Blackwell there means Nvidia is exiting or postponing a major market segment for its flagship product.

Strategic Focus Shift: Nvidia may focus more on other regions (US, Europe, Asia excluding China) or double-down on markets with fewer regulatory constraints.

Manufacturing and Capacity Planning: Lost China demand may shift chip allocation, affects TSMC scheduling, affects how Nvidia budgets for R&D and capital expenditure.

Competitive Landscape: As China develops its own advanced chips (e.g., by firms like Huawei, DeepSeek), Nvidia faces competition at home and abroad, and the restricted Chinese market may mean losing ground to local players.

Implications for China

Push for Self-Reliance: China’s exclusion of Blackwell chips, plus U.S. restrictions, may accelerate efforts to build domestic alternatives. Huang’s earlier comments reflect that export controls may have spurred rather than stalled Chinese development.

Access Delay & Innovation Gap: Without access to the very top tier hardware, Chinese AI firms may face delay in certain research segments. But the gap may narrow if local investment compensates.

Strategic Vulnerability: Reliance on domestic hardware may raise costs or delay development, but also reduces dependency on foreign suppliers.

Broader Geopolitical and Industry Impact

Semiconductor Cold War: The Blackwell story is emblematic of how semiconductors are now central to national-security policy. Chips are no longer just commercial devices—they are strategic assets.

Supply-Chain Fragmentation Risk: If major technology providers like Nvidia cannot operate freely in a region, supply chains may bifurcate: a U.S/EU-led cluster and a China-led cluster.

Global Market Dynamics: Companies must navigate a maze of export controls, regional regulation, and market access issues. The corporate strategy must incorporate geopolitics as much as technology.

Investment and R&D Strategies: Firms may reconsider how and where to invest, partner, and manufacture. Nvidia’s partnership with TSMC and its travel to Taiwan underline how regionalism remains key.

Why Now?

Several factors converge to make this moment significant:

The U.S.–China rivalry over AI supremacy is intensifying.

Nvidia’s Blackwell chip is arguably the most advanced AI hardware commercially available, making it a target for control.

The regulatory environment has become stricter under U.S. administrations seeking to limit technology transfer.

China’s market, while huge, is complicated by policy, restrictions, and rising local competition.

Nvidia’s recent remarks and policies reflect a strategic pivot—accepting restricted access and focusing elsewhere rather than forcing a breakthrough deal.

Looking Ahead

Will China loosen its policies to allow foreign advanced-chip imports again? If so, Nvidia may revive negotiations.

Will Nvidia develop a variant of Blackwell (or other architecture) with reduced capabilities specifically for China? That could happen—but Huang’s tone suggests this is not currently on the table.

How strong will Chinese domestic alternatives become? If strong enough, Nvidia may permanently cede portions of that market.

How will global supply chains adapt? Companies may diversify manufacturing further, reduce exposure to any one region, and build modular hardware strategies.

Will export-control regimes widen to include more countries and more technologies? The Blackwell case may set precedent.

Conclusion

When Nvidia’s CEO states there are no active discussions to sell its Blackwell AI chips to China, it’s not just corporate messaging—it’s a signal of how technology, trade and geopolitics are entwined in the modern era. The question of whether cutting-edge hardware crosses national boundaries has profound implications for corporate strategy, national security, innovation ecosystems and global supply chains.

For Nvidia, the message is clear: Blackwell stays out of China for now. For China, the message is equally clear: local development, self-reliance and alternative paths will likely continue. And for the wider tech world, this is a reminder that the next frontier isn’t just about faster chips—it’s about who gets them, where, and why.